The Carbon Border Adjustment Mechanism

Reading Time: 8 min.

The Carbon Border Adjustment Mechanism (CBAM) is a key measure within the European Green Deal and aims to support the EU's climate targets. This mechanism was introduced to regulate CO2 emissions from imported products and thus prevent carbon leakage. "Carbon leakage" refers to the relocation of production to countries with lower environmental standards. The CBAM has far-reaching significance for global climate policy. By introducing this mechanism, the EU is sending a strong signal for climate protection and promoting more environmentally friendly production worldwide. The CBAM aims to create global competitive conditions that take environmental protection into account and thus promotes international cooperation in the fight against climate change.

1. Basics of CBAM

Definition and mode of operation The Carbon Border Adjustment Mechanism (CBAM) is an innovative measure within the framework of the European Green Deal. It is designed to compensate for the CO2 emissions caused by the production of goods imported into the EU. The core idea of the CBAM is that importers must compensate for the emissions generated during the production of their products. This approach aims to create an incentive for producers to invest in more environmentally friendly technologies and improve their production methods. The aim is to reduce the global carbon footprint.

Affected sectors and products The CBAM focuses on products from sectors that traditionally cause high CO2 emissions. Initially, the CBAM relates to the following sectors:

Aluminium

Iron and steel

Fertilizers

Electricity

Cement

Hydrogen

These sectors are the focus of attention as they account for a significant proportion of global greenhouse gas emissions. By including these sectors in the CBAM, companies are encouraged to develop innovative solutions for more efficient and environmentally friendly production. Targeting these key industries will make it possible to have a significant impact on reducing global CO2 emissions without fundamentally changing global trade dynamics.

2. Effects on the industry

Adjustments in German industry CBAM will bring significant changes for German industry, particularly in emission-intensive sectors such as steel, cement and fertilizer production. These sectors are faced with the task of making their production more environmentally friendly. This could involve investing in advanced technologies, increasing efficiency and reducing emissions. These adjustments are crucial to meet the new requirements while maintaining competitiveness.

Global trends and responses At an international level, CBAM could play a catalytic role in raising environmental standards and moving towards more sustainable production methods. Companies around the world may be forced to rethink their environmental strategies in order to maintain access to the EU market. This could lead to a global shift towards more environmentally conscious business practices and thus have a positive impact on reducing greenhouse gas emissions worldwide.

3. Calculation and pricing

Determining the CO2 price for CBAM products The pricing of CBAM allowances is based on the CO2 emissions generated during the production of the imported goods. This calculation is crucial to ensure a fair and effective mechanism while supporting the EU's climate targets. It is important to note that the pricing of these allowances is market-based and therefore subject to fluctuation. This means that prices for CO2 emissions can vary depending on market conditions, which requires dynamic adjustment to current market conditions.

Role of the EU Emissions Trading System (EU ETS) The EU Emissions Trading System (EU ETS) plays a central role in determining the prices for CBAM certificates. The EU ETS sets prices for CO2 emissions within the EU and these prices serve as a reference for calculating the cost of CBAM allowances. This link ensures that prices for CO2 emissions are consistent and market-based, both within the EU and for imported products.

4. Regulatory and approval procedures

Required permits and certificates With the introduction of the CBAM, companies importing products into the EU will need to obtain certain permits and certificates. These are necessary to comply with the new regulations and to prove that the corresponding CO2 emissions have been offset. The process usually involves documentation of emissions data, verification by approved authorities and the purchase of certificates covering the CO2 emissions of the imported products. Accurate recording and documentation of this data is crucial to ensure transparency and compliance with CBAM regulations.

Consequences of non-compliance Non-compliance with CBAM regulations can lead to various sanctions. These can range from financial penalties to trade restrictions. It is therefore essential for companies to carefully follow the required approval procedures and obtain all necessary certificates. Strict adherence to the rules is not only a question of legal compliance, but also an important aspect of corporate responsibility and environmental protection.

5. Implementation schedule

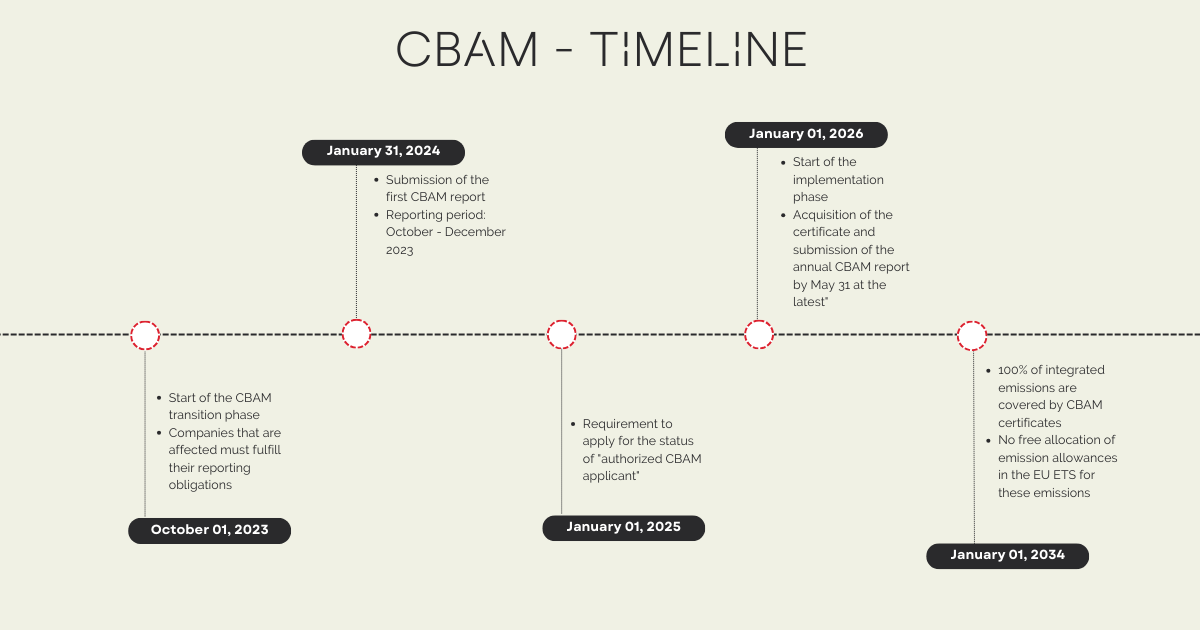

Transition phase 2023-2025 The implementation of CBAM will take place in stages, starting with a transition phase from 2023 to 2025. During this phase, companies will have the opportunity to adapt to the new requirements and make any necessary adjustments. During this time, it will be important for companies to review their processes to ensure that they can meet the upcoming requirements of the CBAM. This transition period is intended to give both companies and the regulating authorities sufficient space to establish the new systems and processes.

Full implementation from 2026 The CBAM will be fully implemented from 2026. From this date, all relevant imports must comply with the new regulations. This means that importers will have to take into account the corresponding CO2 costs for their products and present the required certificates. The full implementation of the CBAM represents a significant step towards the EU's climate targets and is expected to have a significant impact on trade dynamics.

6. International context and incentives

CBAM as an incentive for global CO2 pricing policy The CBAM has the potential to act as a catalyst for a global carbon pricing policy. By introducing a levy on CO2 emissions for imports into the EU, the CBAM sets international standards and motivates other countries to consider similar mechanisms. This could lead to increased global coordination and cooperation in climate policy, which would ultimately contribute to a more effective fight against climate change.

7. Future prospects and possible extensions

Extension of the scope and products included In the future, the scope of the CBAM could be expanded to include a wider range of products and sectors. This potential expansion would strengthen the reach of the CBAM and could help to reduce CO2 emissions in more areas of the global economy. The inclusion of additional products and sectors would also strengthen the EU's efforts to implement a more comprehensive and effective approach to tackling climate change.

Potential developments and adaptations As the development and implementation of the CBAM progresses, further adjustments and refinements to the mechanism may also become necessary. These could be based on feedback from companies, trading partners and other stakeholders and aim to improve the efficiency and fairness of the CBAM. There could also be further developments in relation to the measurement and reporting of emissions in order to increase the accuracy and transparency of the system.

8. Summary and outlook

Key findings and implications for the future The Carbon Border Adjustment Mechanism (CBAM) is a significant step in EU climate policy aimed at reducing global CO2 emissions. By introducing this mechanism, the EU has taken a leading role in global climate protection and is setting new standards for the integration of environmental protection and trade policy. Key lessons learned from the introduction of the CBAM include the need for a globally coordinated effort to combat climate change and the importance of integrating environmental costs into the economy.

Final assessment and possible developments In the future, the CBAM could be further developed to achieve an even greater impact on a global scale. This could include an expansion to other sectors, the improvement of compliance mechanisms and greater international cooperation. The CBAM has the potential to be a model for similar initiatives worldwide and could mark a turning point in the way business and environmental protection are reconciled.

Newsletter Registration

Sign up now for our free Line Up newsletter and stay up to date.